The Payment Practice Regulation (PPR) was introduced to address the lamentable supplier payment performance of UK businesses. The power exercised by larger businesses over SMEs was a particular concern. This was illustrated by the £9.16bn estimated cost to business identified in the supporting papers to the legislation.

As we approach the close of November 2018 when all large organisations (defined below) should have reported at least once, has PPR made a difference?

Results to date (October 2018) suggest there is a wide range of payment practices across sectors and companies. There is little evidence of substantial improvement.

An ethical question

The simple equation is either companies are in control and choose to pay late or are unable to process invoices on time to meet agreed payment terms.

There is an underlying ethical funding dilemma. Large businesses are either using suppliers as a source of cheap funding, or not investing enough in systems and processes to ensure suppliers are paid on time, or both.

The consequences of both are illustrated by Carillion: living off suppliers and the late processing of transactions led them to arrive at a surprise liquidation.

Useful tool?

Supplier diligence performed using the reporting website can be a useful tool. SMEs doing business with large companies can go to the website and select the company to check on the payment practices record.

The tool does not work, of course, if the company fails to report. We ask below if failure to report is an indicator of financial problems.

Failure to report carries a criminal prosecution for each director and a magistrate’s court fine believed to be in the region of £5k.

Reporting

Large organisations have to report every six months. Each business has to report the six months following the year-end within 30 days. A phased introduction saw those with year ends in April 2017 have to report in November 2017.

Large Organisations surpass two of the following three thresholds:

- £36 million turnover;

- £18 million balance sheet total;

- 250 employees.

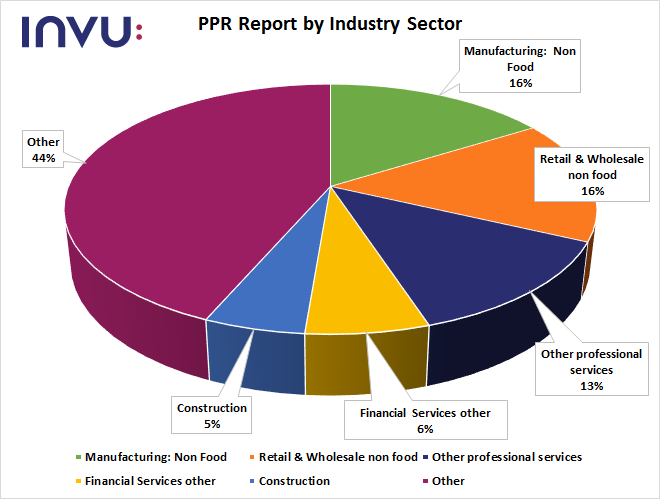

Figure 1: The 5 largest sectors by number of unique reporters

As of 31 October 2018, a total of 6,406 unique organisations had reported. Of these 90 have made reporting errors and are excluded from our analysis and 1,163 have reported for a second six-month period.

We identified that 22 different sectors have reported, and have represented the 5 largest in Figure 1.

Average Time to Pay

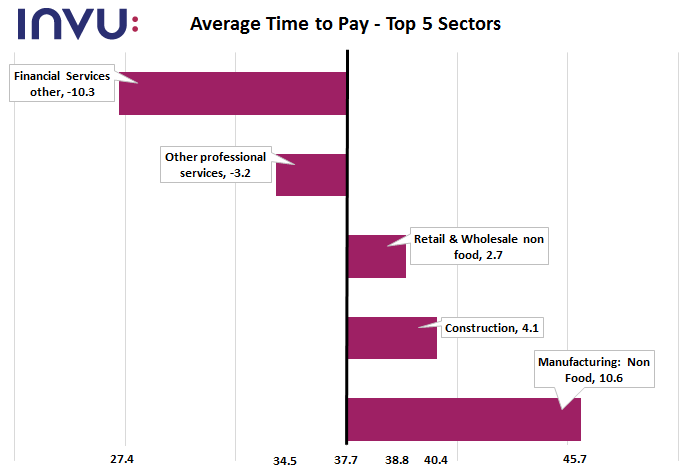

Figure 2: Shows how the largest 5 sectors have performed compared to this average.

The average time to pay reported to date is 37.7 days.

Figure 2 suggests that by custom and practice there is faster payment in the services sector than in the manufacturing sector.

Across all sectors reporting the quickest paying sector was Religious Organisations taking 14 days and the slowest paying sector was restaurants taking on average 69.9 days.

Late Payments

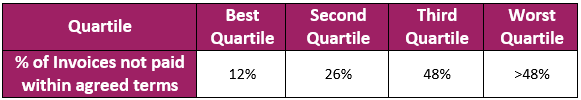

Figure 3: Presents the average % of invoices paid late (outside agreed terms) by all reporters split into quartiles.

The failure to pay within agreed terms, known as “late payment”, occurs on average for 31.9% of supplier invoices.

Using interquartile analysis, shown in Table 1, the best performing larger organisations on average pay 12% or less of their invoices late. This contrasts with the worst performers who pay on average at least four times as many invoices late.

This varies significantly by sector with the best performing sector Religious Organisations paying 7% of invoices late and the worst sector government paying 47.4% of invoices late.

Longest Standard Payment Period

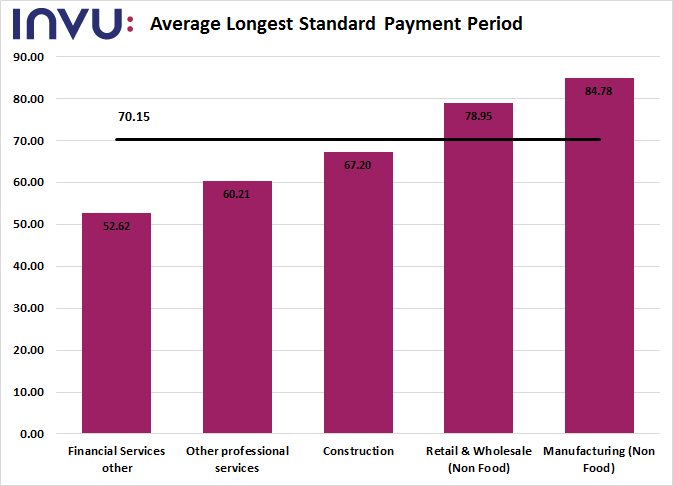

Figure 4: A comparison of the 5 largest sectors’ longest standard payment terms

The terms agreed between large organisations and their supplies are indicative of the buyer’s power.

On average the longest standard terms offered are on average 70 days. We see in figure 3 that the manufacturing sector extracts longer payment terms than the services sector.

This too shows high variation across sectors, ranging from the financial services sector having the shortest standard payment period of 30 days to hotels having a much longer period of 121 days.

Failure to report: an Indicator of Financial Problems?

An SME thinking of doing business with a large company that has failed to report should tread very carefully.

Patisserie Valerie Plc recently reported a huge surprise, cash balances reported as recently as May 2018 at £28m had plummeted to a £9m overdraft by early October 2018 as a result of a £37 million accounting black hole.

The Group Holding Company and its major subsidiary Stonebeach limited should have reported the six months to 31 March 2018 in April 2018 based on their financial year end September 2017. No reports were forthcoming.

This one story may be anecdotal but it seems obvious that failure to comply must be an indicator of some reporting problems which if ignored could be costly to suppliers.

Conclusion

The early indications are that so far PPR has been a failure in terms of radically changing the payment practices of large organisations.

Late payments have not improved significantly comparing those 1,163 organisations that have reported twice (first report 31.9% second report 29.9%) when balanced against the extension of average longest payment terms (first report 70.1 days and second report 70.4 days).

The reports are however a useful tool enabling diligence to be performed on the payment practices of large companies. If this approach is adopted by enough SMEs it could begin to influence the behaviour of the larger companies.

Those businesses who want to be in control of their supplier invoice processing and able to choose when they pay their suppliers (hopefully ethically) should consider automating Accounts Payable or Purchase Order Processing.