Property Management Companies (“PMC’s”) rely on a strong supply chain to run their business effectively. It is therefore important they pay supplier invoices on time.

Paying late, whether by design or error, can reduce trust in the supply chain. Suppliers treated this way may delay, or cancel, the provision of goods or services. This will adversely impact both the experience of tenants and the reputation of landlords under management.

So what are the payment practices and performance of PMC’s?

Should you do business with PMC’s?

Luckily, thanks to the Governments Payment Practices and Performance Reporting Regulation, (“PPR”) we can see exactly how well (or badly) they are doing.

Reporting is required if a PMC surpasses two of the following three thresholds: £36 million in turnover, £18 million on their balance sheet, or 250 employees.

PMC’s represent 77 of 6,438 companies who have reported under PPR.

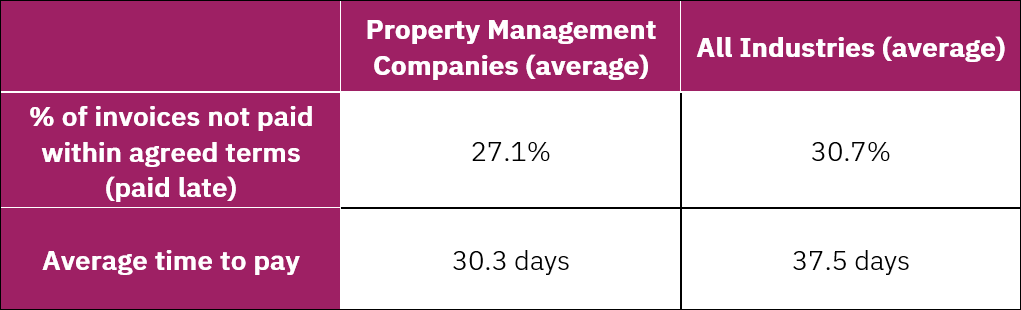

The table below shows that, on average, PMC’s take less time to pay and pay fewer invoices late, than the average for all companies that have reported.

The figures suggest this sector outperforms other industries. Nonetheless, you still risk receiving payments late (outside agreed terms) on over a quarter of invoices on average.

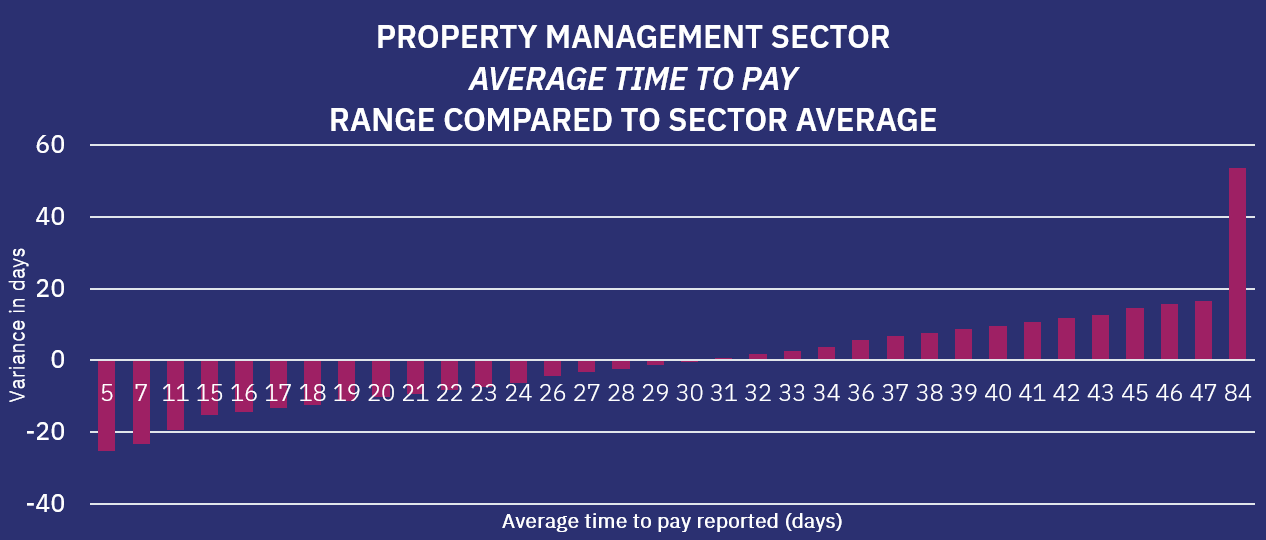

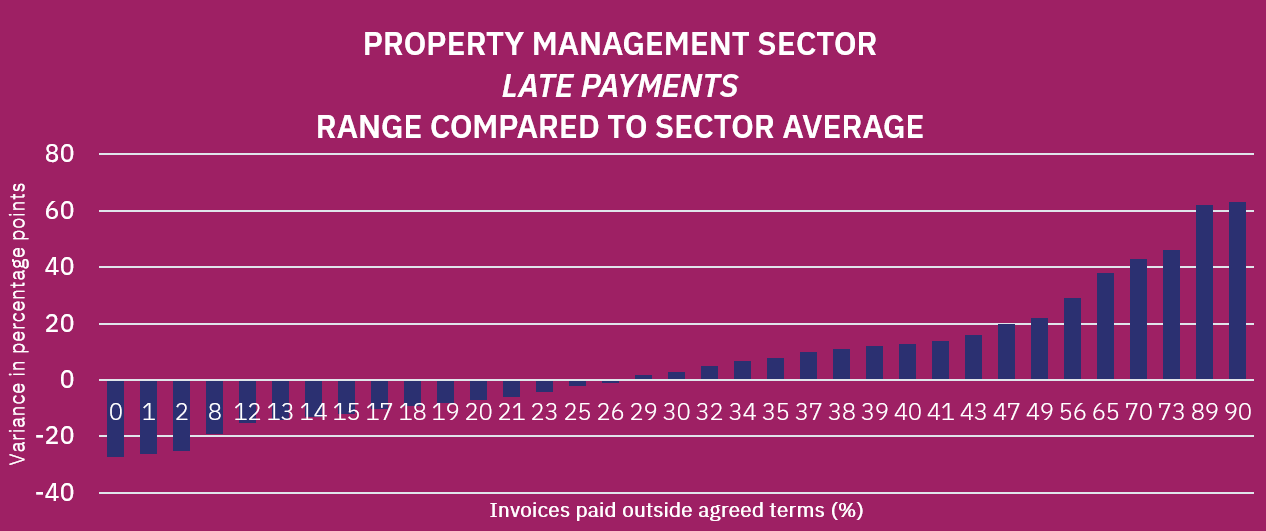

Within the sector, there is a broad range of performance on these metrics. As shown below time to pay can vary between 5 and 84 days and late payments vary between 0% and 90%.

It is therefore important to research the particular PMC you do business with.

The payment dynamics and impact on supplier working capital

Cash flow is important for all businesses. Knowing when you will be paid is critical in terms of understanding the working capital requirements of your business and the amount of funding your business requires.

A supplier into the property management sector would expect, based on the statistics above, on average to receive payment within 30.3 days. So, for example, if their annual turnover was £2.5m (£10k per day based on 250 working days) the working capital requirement would be £303,000 (30.3 days). However, based on the range offered above the requirement could be as low as £50,000 (5 days) or as high as £900,000 (90 days).

Suppliers should expect to be able to plan their cash flow based on agreed payment terms. The statistics above suggest that there is a wide range of performance compared to agreed terms. As few as 0% and as many as 90% of invoices being paid outside the agreed terms introduces a degree of uncertainty into the supplier’s cash flow.

A supplier to the property management sector would clearly prefer to act for those businesses that paid them on average quicker and more reliably. It is therefore likely that those PMC’s who display these behaviours are likely to take priority in the delivery of goods and services when an order is made.

PMC supplier financing?

There is a reason for taking a long time to pay suppliers. The longer a PMC takes to pay its suppliers, the less working capital it requires. A PMC can choose this route, but it is relying on suppliers to partially fund its activities. The recent demise of Thomas Cook has shown the risk of being undercapitalised.

If a PMC is in control of this choice, it knows what it owes its suppliers, and chooses to take its time to pay and agrees longer payment terms with its suppliers. The suppliers may prefer not to accept these longer payment terms, but they have some certainty as to when they can expect to be paid.

PMC’s that have made the choice to partially fund their business by using long payment terms to suppliers, are a particular danger to suppliers when they are unable to meet them. The combination of longer terms and requiring the suppliers to plan for more working capital is made worse by uncertainty surrounding when they will be paid.

Those PMC’s that offer favourable terms to suppliers, but are not able to meet them, also damage their suppliers, because of the uncertainty surrounding when they will be paid.

Being unable to meet the payment terms is generally associated with poor accounts payable processes. These are characterised by a lack of visibility of liabilities and commitments and where supplier invoices are in the process, combined with a lack of efficiency and control over the payables tasks.

Not being in control of the payables process can have wider consequences for PMC’s. Service charges to tenants and landlords may omit supplier invoices, resulting in a loss of reputation and trust when these errors subsequently come to light.

Being “in control”

PMC’s that are “in control” of the accounts payable process have visibility of the amounts they owe suppliers and where supplier invoices are in the process. They can also choose when to pay them.

Being in control can take a lot of resources in a manual environment based on paper invoices.

Software exists that automates the various invoice processing stages. It can be configured to capture data direct from the invoice, put the data into your accounts payable system, send it to the correct employees for coding, routing it for approval, and push it into an ERP system.

This ensures that invoices do not go missing (especially when it needs sending to multiple people and offices), and you can see exactly what stage they are at and who they are sat with so it is easy to see where backlogs are.

See examples of PMC’s choosing this approach here

Conclusion

These Government statistics show that PMC’s are, on average, performing better than the average of all industries. However, the range of results by company suggests that there is a fair bit of risk for suppliers working within the sector. The provision of these statistics gives suppliers the opportunity to gravitate towards those companies with better payment practices and performance.

Those PMC’s with longer payment practices are exposed by these statistics, and this is compounded where they also have poor performance (paying late). Those with good practices but poor performance (late payments) are also exposed and present a risk to suppliers.

There is an opportunity for PMC’s to consider improvements to their accounts payable process, putting themselves in control of their payment performance. The resulting certainty for suppliers would certainly improve the supply chain.

Those PMC’s seeking excellence will pay attention both to their performance and practices.