A fully automated Accounts Payable software solution

Do you worry about being uncertain about how much you are going to have to pay your suppliers this month?

Agilico’s Accounts Payable software automates invoice processing and provides you with real-time financial commitments. This ensures you always have full visibility of where an invoice is at in the process and when they need to be paid.

This certainty over your finances enables you to focus on the activities that help you improve profitability and cash flow.

What Is Accounts Payable?

Agilico offers a fully automated Accounts Payable (AP) software solution to bring visibility, control and efficiency to your organisation’s invoice processing. Our AP solution is about recognising liabilities in good time and being in a position to choose when you settle them.

You set the payment agenda rather than having to react to late payment demands.

With both on-premise and our cloud-based Verify software, Agilico can help you find the best solution to meet your AP needs.

What Does It Do?

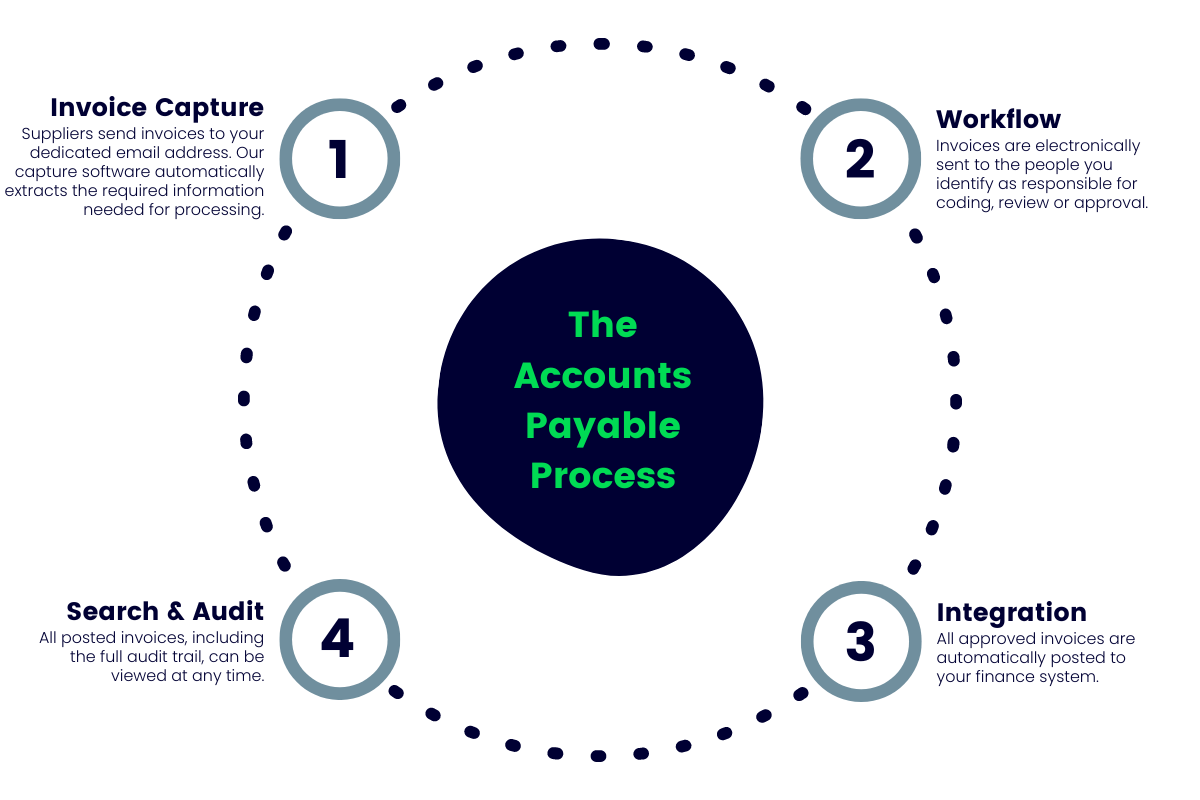

Using invoice capture and AI & machine learning data extraction tools, our solution can automatically pull information from invoices to drive an electronic approval and posting process.

The software is implemented to meet the needs of your business, whether it’s 3-way-matching, routing to managers for approval or simply capturing the invoice, the Accounts Payable solution will adapt to your organisation’s specific needs.

Users have visibility of what stage each invoice is at during the process, allowing them to respond to queries with real-time information.

A full audit trail is available after invoices are automatically posted to your finance system.

Invoice Capture: PDFs, Scanning & Data Extraction

Invoice Capture is the “Front Door” for the whole Accounts Payable process and is designed to efficiently capture all new invoices in the business, extract the key invoice data and ensure all data is valid, so that the following process can be automated based on that data.

Capturing Invoices

Invoices can arrive to many parts of a business. Invoice Capture can be configured to load invoices from any or all of:

- Local Scanner: The AP clerk can scan invoices directly into the product

- Photocopier or Network folder: The product can watch a network folder and bring in invoices that may have

been scanned on photocopiers around the business - Email: Invoices sent to a specific email address can be auto-loaded into the product, which also provides an

audit link between the email and the invoice

Invoice Data Extraction

Data is automatically extracted from the “captured invoice” (without the need for a template per Supplier) to speed up the capture and make the data entry more rigorous.

Most rules are driven using the data from the finance system: Suppliers, Purchase Orders (if used), VAT codes and more.

The Accounts Payable solution also allows for multiple purchase ledgers. Rules governing data quality ensure the data is correct before progressing to workflow. For example, gross, net and VAT values are checked. These rules and data fields can easily be extended to customise the solution for a specific customer’s needs. The Accounts Payable clerk can review, amend, or correct all invoices before releasing the invoice to workflow.

Export to Document Store

Invoice Capture will release the document to the Invu Document Management System for storage and workflow as a text searchable PDF with all the extracted data alongside. Again, the export can be customised easily to deliver the data to other systems at the same time or to improve inter-system audit.

Invu Workflow: Invoice Approval and Coding

The problem in the paper world is that you don’t know where the process is at unless you know where the paper is.

The Workflow module drives the process electronically so that you know who each invoice is sat with, why and how long it has been sat there, at both the transactional and report level if required. No need for paper or the rubber stamp!

Workflow Design and Execution – embodying your specific Invoice process

The Invu Workflow engine will send your invoice on a custom prescribed journey to ensure that invoices get processed and authorised in line with your Coding structure, authorisation levels and organisation structure. The software drives and audits the flow, not the people. When a person needs to do something, a task will be assigned to them.

Email notifications and Web browser User Interface

In most cases, all users need to know about the solution is the email notifications they receive with hyperlinks and the simple interactions on the web browser user interface they see after clicking. Email notifications can be per invoice or more often, such as once or twice daily digest of new items. If there is no new task for them, they get no email.

Coding Task

The Coding task is a special task in the Workflow that enables one or more users to assign budget codes and any additional codes as required to an invoice. The module is very customisable and allows for:

- User list: Controls who will be chosen to code the invoice based on the invoice data

- Code columns: Any number of coding columns can be presented, and the rules for which codes will be selected for each column can be controlled based on the invoice data and the previously chosen columns

- Data-driven: For each Coding line, the assigned user or codes will drive who sees the next task

- 2 stage coding: Coding can be done in two stages by two different people if required where the process involves:

- Separation of Coding work from Authorisation

- Partial Coding by the first person and coding completion by the second person

- Validation: Ensuring that all Coding is correct, the validation will look over all the coding lines’ data to ensure it conforms with the specified rules

Invoice Approval Task

Following Coding, Workflows usually send the invoice on to people for further approval based on authorisation level and department or cost centre (as defined by the customer). This task can be configured with several outcomes but is usually binary, e.g. approve or reject (with a reject reason and note). Workflow can drive several stages of escalation or leap to the right person with the right level as required.

Notes

Notes can be added to an invoice at each stage in the Workflow. Notes do not affect the Workflow, but can provide useful additional context for approval and processing.

Audit Trail & Reports

The Workflow activity is audited so that full visibility of where all in-process invoices are, and how long they have been there, can be seen with a mouse click.

Release for Posting

All invoices completing Workflow are queued in a database for posting into the finance system. This allows Finance to deal with batches of approved invoices on a regular and frequent basis.

Integration: Invoice Posting/Matching

One of the most time consuming and error-prone parts of manual invoice processing is entering the invoice data into the finance system. It takes a significant amount of the accounts payables teams’ time to type in the data and fix mistakes, as well as a lot of time spent ensuring all information is correct at year-end.

Invu Accounts Payable solves this by automatically posting approved invoice data into your finance system. This means there is no more time wasted on manually typing in invoice data nor on fixing errors. It also gives you the confidence that all the data in your finance system is correct.

Invu Accounts Payable can integrate with all finance systems.

Posting

The Invu Invoice Integration module provides the ability to deliver the approved invoices into your Finance system in a controlled and audited manner. Invu will work with any Finance system to achieve effective integration. Out of the box integration is available for Sage 50 and Sage 200 systems, Microsoft Dynamics NAV, Aareon QLF and many more.

Transaction reference/Paid date

Once the invoice is posted (and later paid), this key data is pulled back from the Finance System and stored in Invu Document Management. This allows all Invu users to see the end-to-end essentials of an invoice’s progress without needing to be a user of the Finance system, improving visibility within the business.

Matching (Purchase Order/Receipt/Invoice)

Both 2-way and 3-way matching are fully supported.

Invu for Sage

As a Sage Developer, we have introduced solutions specifically designed for Sage 50 and Sage 200.

Sage 50

Whether you handle 500 or 10,000 invoices per month, lack proper control or have slow turnaround times, the Invu for Sage 50 solution can transform your Accounts Payable function. It provides Invoice Scanning & Capture, online approval and coding, as well as Sage 50 posting and reporting – A complete solution that improves control, visibility and efficiency. The Sage 50 module provides:

- Invoice scanning & auto-data extraction

- Customisable invoice validation rules

- Text-searchable PDF

- Multi-line, multi-budget holder invoice coding

- Controllable batch posting of invoices

- Simple reporting & MI

- API data extraction from Sage 50 for capture lookups

- An integrated posting tool for posting a batch of invoices into Sage 50.

Sage 200

The Invu for Sage 200 solution is designed to help finance departments automate clerical tasks associated with filing and processing invoices, increasing control and visibility of invoices being received. It integrates with your Sage 200 system to compliment your existing working practices, such as invoice approval and invoice coding. The Sage 200 module specifically provides (all API integrated):

- Data extraction from Sage 200 for capture lookups

- An integrated posting tool for batch posting of expense invoices into Sage 200

- An integrated posting tool for batch posting of PO invoices into Sage 200

- Ability to manually post or match invoices by showing and pre-populating the standard Sage data entry screens with the invoice data

- Integrated user experience: Hyperlinks and buttons on Sage forms to display invoices, POs and GRNs based on the selected context.

Search, View & Reporting

Throughout the process and afterwards, access to invoices is essential. Invu’s Document Management solution is an ideal repository for your documents and allows them to be instantly retrieved. Searches can be done on both the invoice data and the OCRd (Optical Character Recognition) content of invoices – it is as easy as using Google. Also key is the ability to have oversight of the whole process with reports giving never before seen insight into the invoice approval process.

The invoices are stored in Invu with all of the meta-data or key indexes extracted or added during the capture process, as well as being updated through the workflow process. Where possible, with the use of the Integration module, user-defined searches are added to the screens. This allows users to view documents directly from within their screens, thus alleviating the need to open additional software for searching. As part of the initial implementation, required search locations are identified and set up before the system’s first use.

Audit Trail

There is a full audit trail of the Accounts Payable process. This includes not only every process transaction, but also every time a user views a document, even if they take no action.

The Invu solution also pulls back the payment date and transaction ID from the Finance system into the Document Management system. This also makes it more economical for a wider range of staff to have access to this data.

Discover Accounts Payable in action…

Interested?

Harness The Power of a fully automated Accounts Payable Software solution

Discover how the friendly Agilico team can support you with both on-premise and cloud-based AP automation.